Why NSW for silver

- Hosts many silver-rich deposits and is a major producer of silver

- Home of the iconic silver-rich Broken Hill Line of Lode

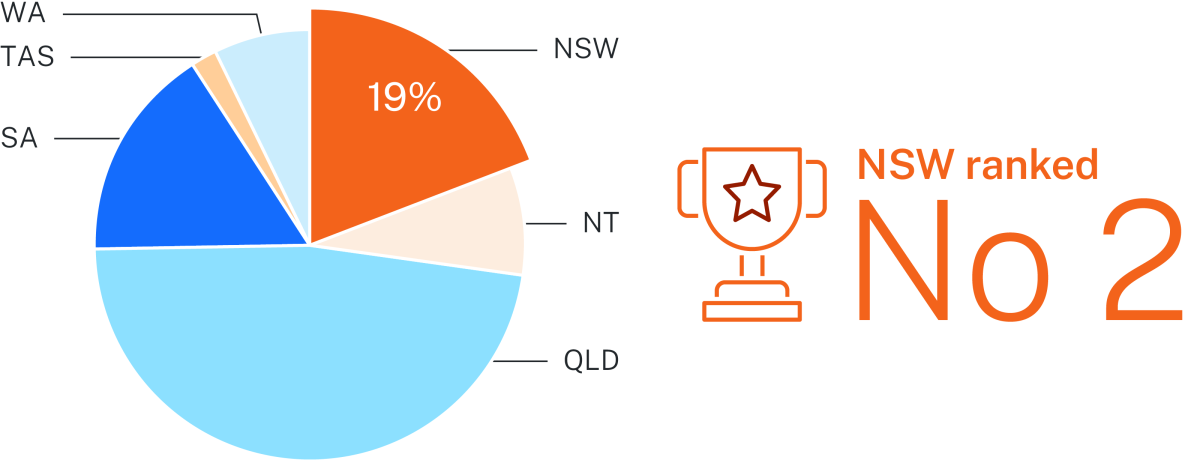

- Second in Australia for silver-contained resources

- Excellent opportunities to discover new deposits and to further develop existing resources

Overview

Silver is valued for its excellent electrical and thermal conductivity, corrosion resistance and antimicrobial properties and low toxicity.

The main uses of silver are in electronics and electrical systems, such as solar photovoltaic cells for solar panels and small amounts in mobile phone and television screens. Silver is used in brazing alloys and solders, industrial processes, silverware, photography, jewellery, and medical applications (notably rapid antigen tests). Additionally, silver has strong demand as an investment product (currency).

Global requirements for silver are expected to increase over the medium term particularly in industrial applications, and as a safe-haven asset amid geopolitical uncertainty. Industrial fabrication reached an all-time high in 2024, driven by silver’s use in solar panels, 5G technology and automotive electronics (Source: World Silver Survey 2025).

The expected increase in demand in solar photovoltaics is likely to lead to a cycle of further investment and cost reductions. However, potential innovations that reduce the amount of silver required could moderate future silver demand.

There was a deficit for silver in 2024, marking the fifth consecutive year of supply shortages – 148.9 Moz in 2024, down from 200.6 Moz in 2023 (Source: World Silver Survey 2025). Deficits are expected to continue in the coming years, despite forecast increases in world production. Silver prices are forecast to remain strong for the medium term, despite increasing supply, due to underlying demand.

NSW resource

NSW is ranked second in Australia for silver contained resources, holding 18% of Australia’s Economic Demonstrated Resource (EDR) (Source: Geoscience Australia, Australia's Identified Mineral Resources 2024).

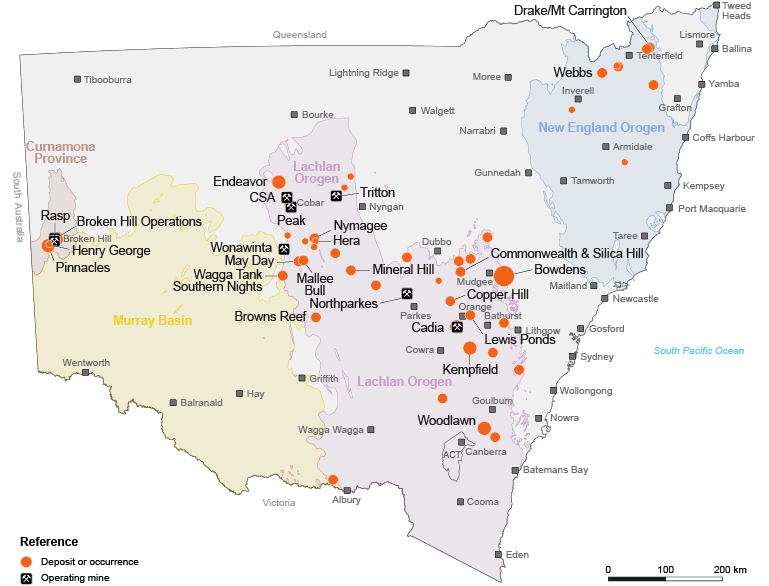

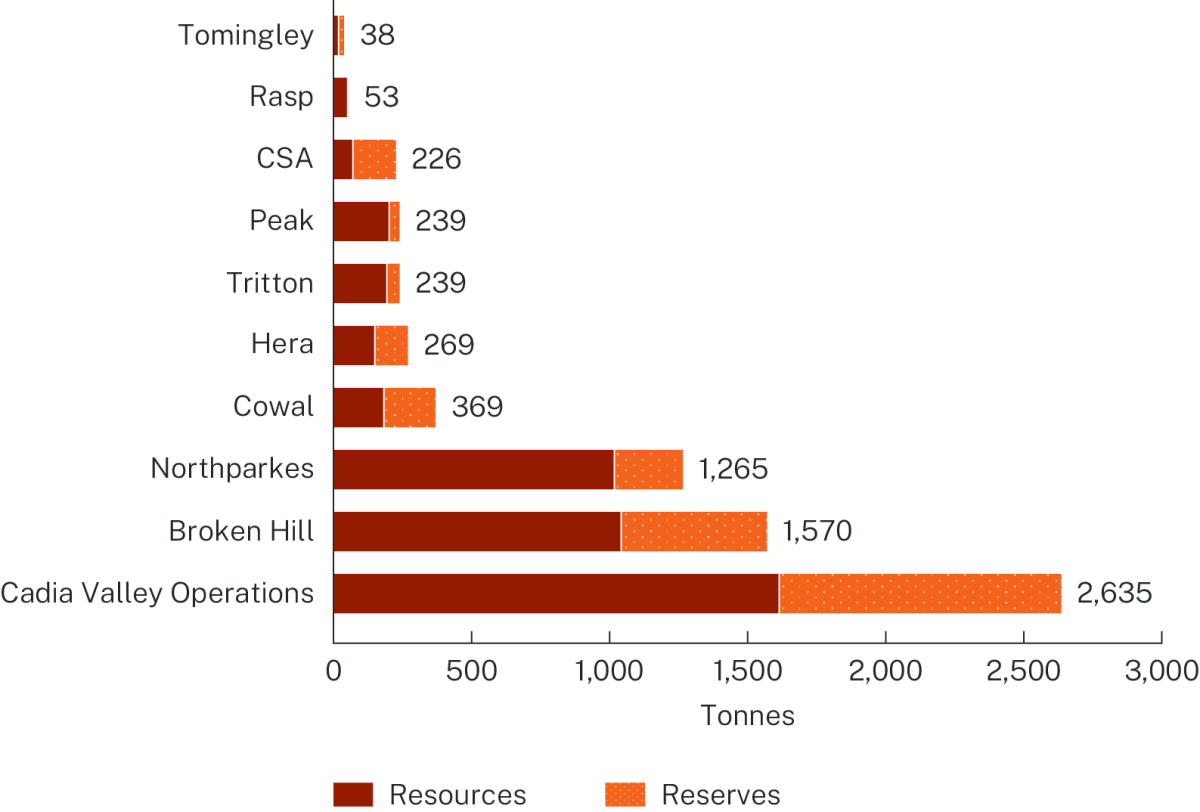

NSW hosts many silver-rich deposits and is a major producer of silver and the home of the iconic silver-rich Broken Hill Line of Lode. Mines such as Broken Hill and Endeavor mainly produce silver, and mines such as Cadia Valley Operations, Tritton Copper Operations and Northparkes produce silver as an important secondary product along with gold, copper, lead and zinc.

Other world-class silver deposits in NSW with significant silver include Woodlawn, Endeavor, and Wonawinta.

There are excellent opportunities for the discovery of new deposits and for the development of existing resources in NSW. This includes the Bowdens Silver Project, which is the largest known undeveloped silver deposit in Australia and one of the largest globally, and the Kempfield Polymetallic Project, which is the second largest undeveloped silver deposit in Australia.

Deposit types in NSW

- Broken Hill Type (BHT): including the iconic Broken Hill lead–zinc–silver Line of Lode.

- Volcanic-Associated Massive Sulfide (VAMS): including deposits such as Woodlawn, Lewis Ponds & Kempfield.

- Epithermal: commonly have significant silver with lead, zinc and/or gold, such as at Mineral Hill, Bowdens and Mt Carrington.

- Sediment-hosted massive sulphide (SHMS): including the world-class Endeavor base-metal deposit, located in the north-western Cobar Basin.

- Orogenic base-metal: deposits can be large, often high grade and can be vertically extensive. Including where silver is a primary commodity (e.g. Thackaringa-type deposits near Broken Hill) and those with significant silver credits along with gold, copper and base metals (e.g. Browns Reef).

- Intrusion-related: commonly polymetallic and can include a range of precious, base metal and speciality metals (e.g. Pb, Zn, Sn, In, Au) with significant silver, such as the Conrad and Webbs silver deposits.

- Carbonate and sandstone hosted systems (MVT): including the Wonawinta silver–lead and De Nardi lead zinc–silver deposits.

Silver in NSW map

Download the Silver in NSW map (PDF, 2.74 MB).

Essential uses

Solar PV |

Electronics |

Electric vehicles and charging technology |

Scientific and medical instruments |

Photographic and x-ray film |

Investment |

Jewellery |

Silverware |

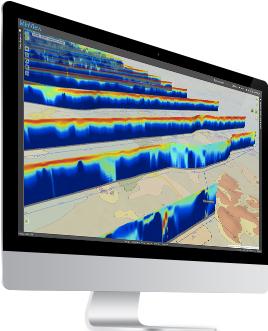

Quality data for explorers

NSW is known for its world class pre-competitive data, and has a long history of providing geological, geoscientific and geochemical data to promote investment in exploration.

Pre-competitive data to support silver exploration (and other commodities) is made freely available on the

Geological Survey of NSW’s web map application MinView.

The NSW Government has recently completed its largest ever geophysical survey acquisition program through airborne electromagnetic, airborne magnetic and radiometric, gravity, and deep crustal reflection seismic surveys. These surveys collected over 150,000 km2 of new data across the New England Orogen, the Lachlan Orogen and the Murray Basin areas that are prospective for critical minerals and high-tech metals, including silver.

Global overview

Global reserves are currently estimated to contain 640,000 tonnes of silver.

Peru has the largest known reserves of silver with about 22% (140,000 tonnes) of the world’s reserves. Australia (94,000 tonnes), Russia (92,000 tonnes) and China (70,000 tonnes) are other countries with large silver reserves.

Mexico was the largest producer in 2024 producing 6,300 tonnes – about 25% of world production (25,000 tonnes).

Australia has the world’s second largest silver reserves and is the world’s ninth largest producer. Source: USGS.

2024 Global silver reserves – 640,000 tonnes silver content

2024 Global silver production – 25,000 tonnes silver content

Source: modified from USGS Mineral Commodity Summaries 2025.

NSW operating mines

NSW produced an average of 100 tonnes of silver per year over the 5 years to 2024-25. NSW silver production from current operating mines was 86 tonnes in 2024-25.

Major silver mine resources and reserves

| Mine |

Contained silver (kg) |

Contained silver (Koz) |

|---|---|---|

| Broken Hill |

1,892,460 |

60,844 |

| Cadia |

1,057,518 |

34,000 |

| CSA |

375,550 |

12,074 |

| Endeavor |

1,369 |

44,021 |

| Federation |

33,600 |

1,080 |

| Mineral Hill |

40,000 |

1,286 |

| Peak |

148,500 |

4,774 |

| Rasp |

487,668 |

15,679 |

| Tritton |

88,000 |

2,829 |

| Woodlawn |

519,800 |

16,712 |

| The contained silver totals are based on combined resources for that project (the amount of silver as a metal that is contained within one or more resources). Source: public company announcements. | ||

NSW project and deposit highlights

| Project (or deposit) |

Contained silver (kg) |

Contained silver (Koz) |

|---|---|---|

| Bowdens |

5,549,000 |

180,000 |

| Bushranger |

373,833 |

12,019 |

| Commonwealth |

93,720 |

3,013 |

| Copper Hill |

53,200 |

1,710 |

| Drake/Mt Carrington |

746 |

24 |

| Kempfield |

2,047,955 |

65,843 |

| Lewis Ponds |

496,000 |

15,947 |

| Nymagee |

29,900 |

961 |

| Overflow |

447,938 |

14,402 |

| Pinnacles |

798,000 |

25,656 |

|

South Cobar Copper Project

|

801,850 |

25,780 |

| Webbs |

308,000 |

9,902 |

| Wonawinta |

1,581,790 |

50,856 |

| Total contained silver |

12,581,932 |

403,100 |

| Note: The contained silver totals are based on combined resources for that project (the amount of silver as a metal that is contained within one or more resources). Source: public company announcements. | ||

Notes:

All percentages (including in the pie charts) are rounded to whole numbers.

Forecasts are based on NSW Resources’ interpretation of available information. Forecasts are inherently uncertain and should be seen as a guide only. Actual outcomes may be different.